Payment security is one of the most critical—and complex—parts of fintech software. Whether you’re building a digital wallet, loan platform, or e-commerce payment app, startups face a dilemma: how do you build fast without compromising security?

Thankfully, with custom app development for new businesses, it’s now possible to implement secure, scalable payment systems using proven building blocks like APIs, SDKs, and security protocols—all while focusing on innovation.

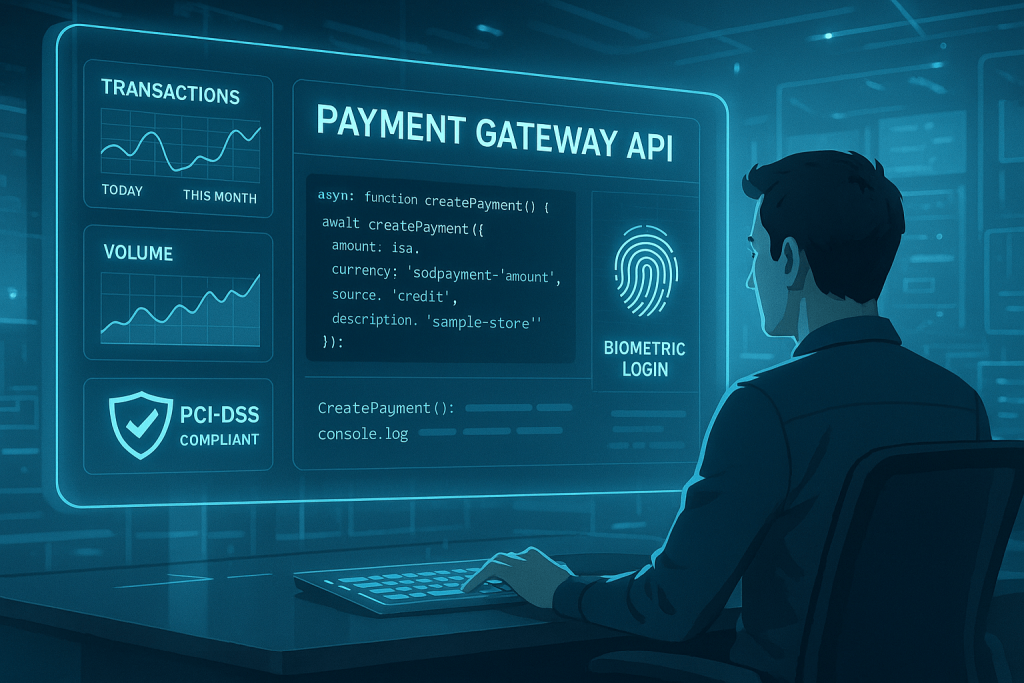

Step 1: Use Pre-Certified Payment Gateways

Building your own PCI DSS-compliant backend is expensive and time-consuming. That’s why most startups rely on existing gateways like Stripe, Razorpay, or PayU, which offer:

- PCI-compliant encryption and tokenization

- Support for UPI, cards, wallets, BNPL

- Fraud detection with 3DS and risk scoring

Integrating these tools through secure APIs reduces compliance burdens dramatically.

Step 2: Secure Code Practices Are Non-Negotiable

Even with third-party services, your app must prevent vulnerabilities like:

- Insecure API calls

- Improper input sanitization

- Hardcoded credentials in codebase

Using startup workflow automation tools like CI/CD pipelines and automated security tests can catch issues early.

Step 3: Modularize the Payment Logic

In modern business automation platforms, it’s ideal to separate your core payment module from the rest of your logic. This lets you:

- Switch providers without rewriting code

- Test payment flow in isolation

- Comply faster with region-specific rules (like RBI mandates)

Step 4: Real-Time Transaction Monitoring

Secure apps provide real-time logs for every payment event. Whether it’s a payment success, refund, chargeback, or retry, maintaining logs helps:

- Diagnose failed transactions

- Detect patterns of misuse or fraud

- Offer faster customer support with CRM software for tech startups

It’s a best practice to sync transaction logs with your CRM and analytics tools for better reporting.

Step 5: Educate Users on Security

Even with a secure backend, breaches often happen due to end-user mistakes. That’s why successful fintechs:

- Use OTP or biometric logins

- Prompt strong passwords and 2FA

- Display security education on first-time use

Bonus: Recommended Tech Stack

| Component | Suggested Tools |

|---|---|

| Payment Gateway | Razorpay, Stripe, Cashfree |

| Security Layer | JWT, bcrypt, OWASP ZAP |

| CI/CD Automation | GitHub Actions, Snyk, SonarQube |

| CRM Integration | Hubspot, Zoho, CodnestX CRM |

Conclusion: Build Secure, Scale Smart

By focusing on modular architecture and API-first integrations, startups can ship faster without compromising safety. Through custom app development for new businesses, even small fintech teams can launch enterprise-grade payment systems with agility and trust.